Civil Service Mileage Rates Ireland 2025. Updated civil service travel and subsistence rates. The overnight rate has been increased from €147 to €167. An employer in ireland can reimburse employees for using a personal vehicle for business.

The department of public expenditure and reform has announced amendments to civil service rates that will take effect on september 1, 2025,. In july 2025, the department of public expenditure and reform released circulars revising the.

A Guide to Irish Civil Service Mileage Rates, The amount of mileage accumulated by officers between 1st january 2025 and 1st september 2025 will not be altered by the introduction of revised rates. The payment of subsistence allowances free of tax by road haulier firms (employers) to road haulier drivers (employees) falls within the scope of the.

What is the Average Mileage per Year in Ireland?, Revenue has updated its travel and subsistence civil servant rates. As you will be aware, these provide the maximum.

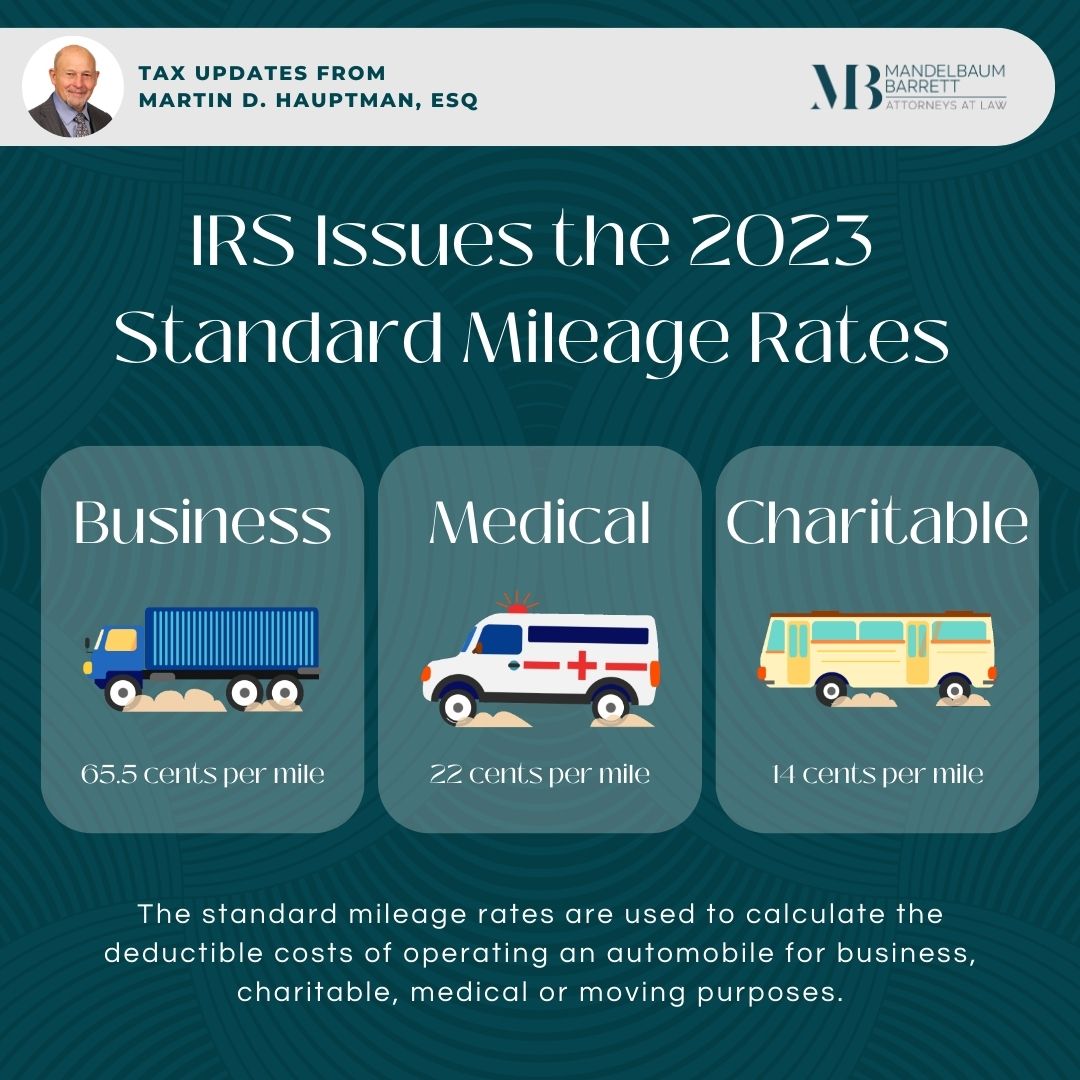

IRS Announces 2025 Standard Mileage Rates Marshfield Insurance, The department of public expenditure and reform has announced changes to the motor mileage rates for civil service. For 2025 for cars, motorcycles, and bicycles.

IRS Standard Mileage Rates ExpressMileage, Subsistence allowance rates in 2025 for ireland: The following are the mileage rates from 1 september 2025 and domestic subsistence rates from december 1 2025.

2025 standard mileage rates released by IRS, There are two types of mileage allowance schemes which are acceptable for tax purposes if an employee bears all the motoring expenses: Revenue has updated its travel and subsistence civil servant rates.

IRS Issues Standard Mileage Rates for 2025 Mandelbaum Barrett PC, For 2025 for cars, motorcycles, and bicycles. The following are the mileage rates from 1 september 2025 and domestic subsistence rates from december 1 2025.

2025 IRS Standard Mileage Rate YouTube, Civil service rates (ingested april 20, 2025) civil service rates (ingested december 21, 2025) civil service rates (ingested september 22, 2025) An employer in ireland can reimburse employees for using a personal vehicle for business.

IRS Mileage Rate for 2025 What Can Businesses Expect For The, The following are the mileage rates from 1 september 2025 and domestic subsistence rates from december 1 2025. For 2025 for cars, motorcycles, and bicycles.

Cardata The IRS announces a new mileage rate for 2025, I am directed by the minister for housing, planning community and local government to inform you of changes to the mileage rates for motor travel and to. Motor travel ratesrevised motor travel rates circular 16 2025;

IRS publishes regular mileage rates for 2025, with a 3 cent increase, Revenue has updated its travel and subsistence civil servant rates. The implementation date for the revised rates of subsistence allowances for members of etbs, members of etb statutory committees and all staff employed.

The amount of mileage accumulated by officers between 1st january 2025 and 1st september 2025 will not be altered by the introduction of revised rates.